The Intrinsic Necessity of Capitalism 2026-01-29

When early humans started to form tribes and villages, they were creating social structures where some people didn't need to go out hunting because the hunters and farmers could produce a lot more food than they were able to consume by themselves. That allowed other people to learn skills which aren't necessarily crucial for survival, but can immensely benefit the overall community. For example, tailors can produce protective clothing, blacksmiths can produce metal tools and weapons, builders can construct houses and other structures, and teachers can ensure all of that knowledge is passed on to future generations.

All of those jobs provide some positive benefits which are valued by the community. Every person in the village is expected to contribute something of value to society, so that life will be easier for everyone. The hunters often risk their life to obtain food for the village, and they will not like the idea of having to feed a person who never gives anything back to society. In this type of society money isn't really required at all; the food, clothes, tools, etc, represent the wealth owned by the community, and everyone will receive some share of the group resources if they contribute something to the group.

The village chief and those with a higher social status often receive a larger fraction of the group resources, but for the most part everyone else will receive an equal share. If someone in the village desires something more than everyone else, like a spare set of nice clothes, then they will have to trade something of similar value for the clothes. They could also trade some of their free time by doing extra work. For example the blacksmith could use his spare time to make some more tools, and the tailor could use some of his free time to make some extra clothing. Then the blacksmith and tailor could trade items.

Even with such a simple economic framework, we can already see how the foundations of capitalism and free trade will naturally arise, even without money or currency. A primitive village society would be highly communal but the concepts of private ownership and free trade will still be important to them, and as the village grows in size those concepts will become crucial. Let's imagine our villagers come into contact with some nearby villages, but the people in those other villages have different belief systems and different social structures, preventing them from merging into one single society.

However, some groups have resources and skills that other groups lack, so they begin trading items of similar value just like the blacksmith and the tailor. Those groups with a surplus of a particular resource can trade it to the groups with a shortage of that resource. It also allows each group to experience some of the food and culture of the other groups and overall it has a positive economic effect for everyone. Eventually they realize that trading rare items like precious metals is a much easier and much more practical way of conducting trade, allowing them to sell and buy products with much less friction.

Even the most communistic nations on Earth are still forced to partake in international trade when necessary to sustain their way of life, for example China is the world's largest exporter by a significant margin despite being ruled by the Chinese Communist Party for over 100 years. In the future we may come into contact with a friendly alien civilization, and we could all benefit by trading and sharing our cultures, just like the villages. If we have resources the aliens desire then they might trade with us, but it's unlikely they will give us a bunch of free resources out of the kindness of their alien hearts.

People often say that money is the root of all evil, but money is simply a vehicle for transferring economic value, it allows us to trade our work for things that make life easier and more enjoyable. Using gold for trade is no more evil than using grains of rice, it's just more practical. Gold has many uses and is scarce, so a small amount of gold can hold a large amount of intrinsic value. But why even bother lugging around gold when we can simply create paper notes which are backed by gold, and convertible into real gold... well the U.S. dollar was backed by gold for some time until the gold standard was ended in 1971.

After the gold standard ended the U.S. dollar became a fiat currency backed by nothing more than faith in government. Almost all governments of the world have now adopted a fiat currency, allowing them to print as much money as they desire, which can lead to hyperinflation if they create too much. That is why some nations have a currency with massive denominations, for example Zimbabwe has a one hundred trillion dollar note which was first issued in 2009 during a period of hyperinflation. They obviously didn't choose to use such huge denominations, they were forced to because they over-inflated the money supply.

Many people seem to think that inflation is caused by resources becoming more scarce, which increases the cost of those resources. Obviously that can happen, but the primary cause of inflation is almost always the government spending money they don't really have. They are literally inflating the money supply, which is how we end up with situations where people are buying a loaf of bread with a wheel barrow full of notes. In 2022 Argentina experienced almost 100% inflation, all that currency didn't magically fall out of the sky.

The government of Argentina injected a huge amount of money into circulation in order to pay people who were stuck at home due to the pandemic. Prices increased to compensate for the new currency in circulation, and the government created even more money trying to remedy the situation. That cycle is exactly how hyperinflation usually occurs, it's when people ignore the intrinsic forces of the free market and think they can control it. The Argentinian government also tried to enforce price controls but prices still rose rapidly. When a government starts trying to control prices it's usually a sign of a failing economy.

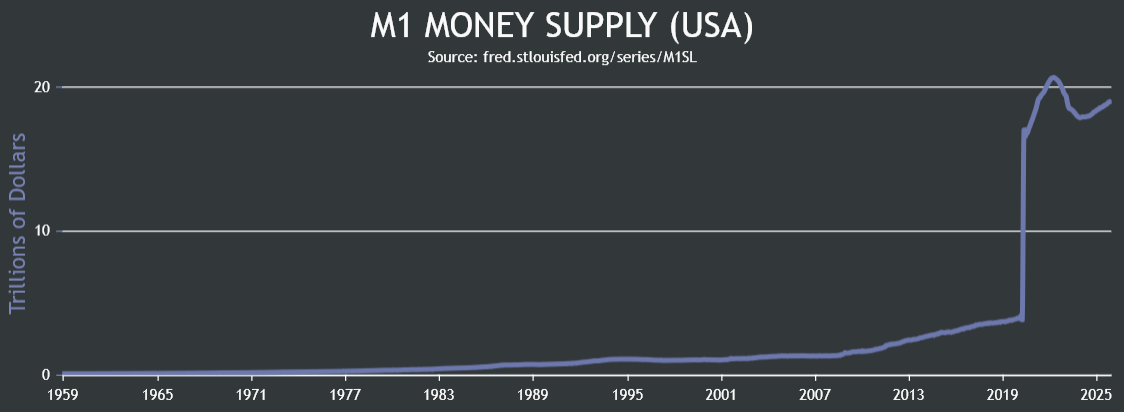

It wasn't just Argentina that suffered, almost every nation in the world experienced high levels of inflation and large price spikes. That's because many countries created an absurd amount of new money throughout the pandemic, and at the same time they shut down their economies which halted or reversed GDP growth. It was a highly destructive economic plan which packed a decade worth of damage into a couple of years. Even the United States injected a very large amount of new money into circulation, almost 5 trillion dollars. Take a look at this chart showing how the M1 money supply changed during the pandemic:

Looking at the jump which occurred during 2020, you might think the M1 money supply went from 4 trillion to 20 trillion, suggesting they created 16 trillion dollars. In May of 2020 the definition of the M1 and M2 Money Supply was conveniently changed, making it a bit more difficult to work out how much money was actually created. The Federal Reserve claims that the M1 was redefined to include the industry total of savings deposits, which amounted to approximately $11.2 trillion. If we subtract 11.2 trillion from 20 trillion, and also subtract the 4 trillion we started with, that leaves 4.8 trillion dollars.

Considering the M1 money supply was at 4 trillion before the pandemic, that means the M1 money supply more than doubled in a shockingly small amount of time. The USA spending website provides official data on COVID relief spending and they give a figure of 4.7 trillion, which aligns with our result of 4.8 trillion. Just think about that, they spent more than the entire M1 money supply on COVID relief, and it appears the vast majority of that money came in the form of newly created money. The M1 money supply basically refers to all liquid currency in the money supply, things like cash and money held in bank accounts.

Did the money in your bank account double during the pandemic or do you get paid twice as much? I can bet most people reading this have about the same or less money in their bank account compared to what they did before the pandemic. Somehow the M1 money supply doubled, but for most people that money is no where to be seen. However, it must be out there somewhere in the bank accounts of the ultra rich. That means the government response to COVID resulted in the largest transfer of wealth in human history and massively increased wealth inequality. All the money people got from the government was quickly spent and given to corporations.

In many nations, small businesses were forced to close and everyone was forced to shop at one of the big supermarket chains, and those big chains made record profits. In Australia I've seen many people claim those record profits were a result of price gouging, when in reality people had a bunch of free money and they were forced to spend it at certain places. Grocery prices rose primarily due to increased operational costs, caused by the high levels of inflation that occurred during the pandemic. Why weren't they rapidly raising prices before the pandemic, and why would they purposely raise prices so rapidly during a crisis?

They aren't comic book villains, there are real economic forces at play. If you shop at a smaller grocery chain or local store in Australia, the prices will most likely be even higher, because those small chains can't match the efficiency and scale of larger chains. If we assume the problem is just evil business owners, we overlook the real problem, and if we don't truly understand the problem, we will never be able to fix it. The primary reason I'm writing this article is because I want people to understand the underlying reasons why the cost of living seems to constantly rise and how we might be able to reverse that trend.

Let's imagine that a mining company discovers a gold ore deposit so large it would double the supply of gold. The basic rules of supply and demand tell us that the value of gold will be cut in half if the demand for gold stays the same. In reality economics doesn't always work so neatly, for example some very wealthy people are likely to hoard some of that new gold and it wont be in active circulation so it wont have such a large impact on the market. However, it will still have a big impact on the market and the value of gold will drop considerably. Similar economic forces are at play if we double the money supply.

Even though fiat money has no intrinsic value like gold, each dollar is still a container for monetary value, so printing more dollars makes the others worth less. When the dollar loses purchasing power, prices will rise because each dollar is worth less. Government fiat money is a very complex and tricky beast, and there are many intentional mechanisms which have been put in place to reduce the impacts of inflation or delay it. One way they do this is via debt-monetization methods, meaning the government doesn't just create new money, the central bank issues them the new money in return for government bonds.

Those bonds represent debt the government has promised to repay with interest, and that promise to repay can help delay the impact of inflation so it happens more slowly over a longer period of time. That's one of the reasons we keep seeing high levels of inflation several years after the pandemic has ended. The cost of living will always increase as long as our government fails to have a balanced budget and has to borrow money from the central bank. The government is always getting larger, more employees, more laws, etc. Therefore they always require more money and government debt is always increasing.

Looking at the history of the United States debt ceiling we can see that the ceiling is rising exponentially, because the national debt is also increasing exponentially, primarily as a result of increased government spending. If they can't make a deal to increase the debt ceiling every few years, they can't accrue more debt so they can't keep increasing government budgets. This of course can have very serious economic consequences and even lead to government shutdowns. We are told it's absolutely crucial that the debt ceiling is increased every time it is reached, as if this can simply go on forever.

The Committee for a Responsible Federal Budget recently released a report warning that the U.S. national debt has reached alarming levels:

The U.S. national debt is approaching record levels as a share of Gross Domestic Product (GDP) and currently stands at 100% of GDP, while interest costs are surging to new records and budget deficits remain elevated at around 6% of GDP. High and rising deficits and debt can have many consequences, including that they can put upward pressure on inflation, boost interest rates, slow income growth, reduce fiscal space to respond to needs or emergencies, and weaken our national security. Perhaps most concerning, excessive debt could lead to a fiscal crisis. If the national debt continues to grow faster than the economy, the country could ultimately experience a financial crisis, an inflation crisis, an austerity crisis, a currency crisis, a default crisis, a gradual crisis, or some combination of crises. Any of these would cause massive disruption and substantially reduce living standards for Americans and people across the world. What Would a Fiscal Crisis Look Like?

As the government expands, it requires more and more money to pay for their operations, but at the same time it becomes less and less efficient at managing and spending money because a highly bloated government is a very complex system and it's very hard to operate in an efficient manner. The result is an ever increasing debt ceiling caused by out of control spending. This is precisely why it's so crucial to minimize reckless spending, and why we should be supporting the people who are trying to do that instead of attacking them. Their actions ultimately benefit everyone by creating a healthier economy.

The U.S. dollar now has less than 1% of it's original purchasing power because even a small amount of inflation every year can compound into a large amount of inflation. Every time the government borrows money it increases the interest owed on its debts, and it also causes inflation by injecting new money into circulation. More debt and a weaker dollar means the government needs to spend even more in order to cover their costs, they also need to spend more money trying to fix the cost of living problem caused by inflation. Consumers suffer while politicians increase their own wages every chance they get.

As the crisis continues to get worse, people demand more of the exact same thing which caused the problem in the first place; more free money and more social welfare, which inevitably results in more taxes so the government can pay for it without generating too much new debt. In order to increase spending they either need to increase taxes or print more money, both of which increase the cost of living. Increasing taxes has a similar effect to creating new money because businesses will increase product prices to cover the loss of increased taxes, thereby offsetting the cost of the tax onto consumers.

I strongly believe socialist policies can work well when properly balanced with capitalism. All nations on this Earth use some mix of socialism and capitalism. In Australia we have a lot of social services that our taxes fund, and many of them benefit society immensely. The real problem arises when we allow excessive socialist policies to undermine the foundations of capitalism. We cannot ignore free market philosophies and assume socialism will create a utopia despite its countless failures throughout history. We should always be skeptical of those who promise us utopia through big government.

The real problem is when we decide socialism works so well we should trade all of our liberty in return for the safety provided by a nanny state. The true threat of socialism arises when society at large decides we should totally abandon free market philosophies and give the government a huge amount of power over the way we live our lives and conduct business. Free market capitalism will always be superior to overzealous socialism for a simple reason: capitalism arises naturally when a society of people engage in free trade, whereas excessive socialism requires governmental force to ensure some degree of equality.

It's very easy to see which direction society is headed, and that concerns me. Many socialist ideals are promoted using arguments which appeal to our empathy and our humanity in order to make people think they are the most righteous and ethical policies, despite the fact that they don't encourage innovation and they lead to uncontrolled government expansion, producing stagnant economies at the end of the day. The road to hell is truly paved with good intentions and this is a perfect example of that. Too much of a good thing can be bad, and at some point it becomes unfair to the tax payers who generate the economic value.

Critics of capitalism say it's based on selfishness, but I think what's more selfish is to expect that one should have a right to the same amount of wealth as everyone else even if they contribute nothing. Of course there should be exceptions for people who are unable to work due to a disability or health condition. We should even try to support people who are unemployed but actively looking for a job, but there also needs to be strong motivations for them to find a job and not just rely on government payments. We simply can't spend endless amounts of money solving every social issue in existence.

A healthy economy can easily afford to support people who can't work, but if we ignore what made the most wealthy and powerful nations so wealthy and powerful in the first place, we will only end up hurting ourselves. By cutting reckless spending and balancing the budget we can ensure the government is streamlined and efficient. That creates a strong currency and strong economy which benefits the millions of citizens participating in the economy and increases the overall standard of living. You also prevent future generations from being burdened with huge amounts of debt that they had no part in creating.

A government that grows faster than the economy will accrue debt at an exponential pace, and that will obviously become unsustainable before too long. There must be some mechanisms in place to limit the endless expansion of government, to limit tax increases, and to limit the amount of money they can print/create. If we have no mechanism in place to control government bloat, we end up with extremely inefficient governments which waste our money on ridiculous nonsense at a record pace. It's not about taking away government welfare, it's about creating a healthy economy which benefits society as a whole.

When we decide that increasing taxes and expanding the size of the government is always a good thing we are heading down a very precarious path, and I'm seeing that type of thinking now more than ever because the U.S. government is cutting regulations and trying to get a handle on government debt by cutting costs. Most governments in the world are up to their eyeballs in debt because they are addicted to spending, and the only way they can pay off much of that debt is to take more and more money from individuals and businesses. Excessive socialist policies require us to give up an excessive amount of personal liberty.

Ultimately it's a choice between freedom or governmental coercion and intrusions into the way we live our lives. This is the core difference between people who promote a one world government and those who oppose it. Those in favor of it may say "oh but it's for the greater good, it's an all powerful government that can care for every person on Earth". They are willing to put all their faith in one highly centralized authority, trusting it wont abuse that power. While it might sound like progress and unity, it's a very dangerous road to go down. Blindly doing things for the "greater good" is not always the right choice.

For example would you want to live in a society where everyone is assigned an occupation by the government in order to most efficiently meet the needs of the population? It would be for the greater good, there would never be a shortage of doctors, but would you actually be willing to give up that amount of liberty? At what point do your own desires and aspirations outweigh the need of the greater good? Most people only look at the short term benefits of more socialism without really considering the long term costs or the end result, which is typically a highly centralized and highly authoritarian government.

In recent years I've seen a lot of books, films, and even video games which criticize capitalism by pointing out how dystopian things can become when corporations gain too much power, but I think it's also worth remembering just how dystopian things can become when we decide that the government should have total control over how we live our lives, because we rarely see that situation depicted in popular media. Just look at North Korea, they can only access an intranet with state-approved content and everything they do online is monitored. They also use a state-approved operating system called Red Star OS.

The operating system contains state made spy-ware which can detect forbidden content and trace it back to the original computer it came from so the distributer can be prosecuted. The forbidden content could be something as simple as a meme which shows disrespect towards their leader. On the other hand, South Korea has some of the fastest internet connection speeds in the world. After separating from North Korea and embracing capitalism they have risen to be one of the richest and most technologically advanced nations on Earth, producing electronics, music, and television programs enjoyed by people around the world.

South Korea is notable for its rapid economic development from an underdeveloped nation to a developed, high-income country in a few decades. This economic growth has been described as the Miracle on the Han River, which has allowed it to join the OECD and the G20. It is included in the group of Next Eleven countries as having the potential to play a dominant role in the global economy by the middle of the 21st century. It has the 4th largest economy in Asia and the 13th largest in the world as of 2025. It is a developed country with a high-income economy and is the most industrialized member country of the OECD. South Korea was one of the few developed countries that was able to avoid a recession during the 2008 financial crisis. In 1950, a North Korean invasion began the Korean War and after its end in 1953, the country's economy began to soar, recording the fastest rise in average GDP per capita in the world between 1980 and 1990. Authoritarian rule ended in 1987 and the country is now the most advanced democracy with the highest level of press freedom in Asia. Its citizens enjoy the world's fastest Internet connection speeds and the longest years of tertiary education in the world, along with the world's second best healthcare system and most equal access to quality healthcare, resulting in the third highest health adjusted life expectancy in the world. South Korea and the Economy of South Korea

Much like North Korea, China has their own intranet and the "Great Firewall of China" blocks access to many international sites including Google and Facebook. They also have a very dystopian social credit system which places severe restrictions on people with a bad score, similar to what we see in the episode of Black Mirror titled Nosedive. We also cannot ignore the fact that the largest famine in human history was caused when the Chinese Communist Party attempted to seize the means of production in the late 1950's by making private farming illegal and labeling anyone engaging in it a counter-revolutionary.

It's estimated that between 15 and 55 million people died during the Great Leap Forward as a result of famine and political violence. Wikipedia states that restrictions on rural people were enforced with public struggle sessions and social pressure, and forced labor was also exacted on people. A struggle session was a violent public spectacle where "class enemies" were humiliated and often beaten to death. Historian Frank Dikötter asserts that "coercion, terror, and systematic violence were the very foundation of the Great Leap Forward" and it "motivated one of the most deadly mass killings of human history".

Many people in current times despise capitalism and want to escape it, but we really shouldn't take for granted how much freedom we have in Western nations, and we need to realize how much abundance we actually have, even now when the cost of living seems to be out of control, the cost of living crisis in the USA is much less severe compared to the rest of the world. More importantly, we need to look at the underlying reasons why the cost of living has been rising so quickly all around the world, and acknowledge the fact that the more we try to escape capitalism, the more the cost of living rises, and the worse our lives become.

We've already seen how unsustainable government spending can cause inflation and push up prices, so if we truly want to turn this situation around then we need to get back to the core principles our economies were founded on. Obviously some rules and regulations are necessary for free market capitalism to remain free and fair, I'm not saying it's a perfect system, it certainly has flaws. I also think some smart socialist policies can help balance out some of those flaws and help lift up those at the bottom. At the same time we must create realistic economic policies that respect the laws of supply and demand.

There's a limited supply of land on Earth and our population is always increasing, so we cannot all own a river side mansion, it's just not physically possible, we cannot all have perfectly equal living conditions. Prime real estate is always going to be scarce so how do we ever decide who gets the best plots of land if we have no money? Also, many items have value because they were painstakingly hand crafted, like high end watches or works of art like paintings and statues. Even in a purely communist nation, money will always have a place in society whether the government likes it or not, people want to own things.

I don't want to live in a world where I "own nothing but am happy". At the end of the day that's all capitalism really is, it's the private ownership of resources which enables trade between each party participating in the economy. Money isn't even truly necessary for it to work, the main purpose of money is to simplify trade and barter. Some people will inevitably end up with much less resources than other people, but at least capitalism provides the opportunity to move up. Capitalism gives us a chance to educate ourselves and put in the effort required to become an expert or entrepreneur.

It's unlikely we would have so many highly trained doctors if they weren't being rewarded in a way which made it fair to them. Many people would avoid being around sickness and death every day when they could do any other job and be rewarded the same, so the government would need to assign occupations to people in a system aiming for perfect equality. Capitalism gives incentive for people to work on stuff which will meet the needs and wants of other people, so they can sell that service or product to other people. Society would fail if everyone worked on what they want instead of what there is a market demand for.

The Venus Project promotes an economic system where people don't have to work at all because their needs are met by a centralized production system controlled by a one world government which decides how to distribute all the worlds resources. When a government seizes the means of production the production process becomes highly centralized and bureaucratic, making updates and innovation to product lines difficult, it also limits us to government approved products. Financial incentives are the single greatest driver of innovation, and one doesn't necessarily need to be rich in order to invent and innovate.

For example, it costs me nothing to write software some people will pay money for, all it really takes is some clever thinking and the drive to produce a finished product. We've seen many times throughout history that when a government tries to seize the means of production it leads to wide spread famine and poverty. If AI eventually replaces most jobs, people will require some form of Universal Basic Income, and it will be the same for all unemployed people, which would result in more equality. However, a UBI wont make anyone wealthy, the government can barely afford to pay unemployed people as it is.

Very few of us will be able to afford that dream boat we always wanted, except maybe those people who had lots of money before the UBI was implemented. True wealth equality sounds good in theory, but very few of us would actually choose to live in such a world if given the chance. I know I'd much rather live in a world where I have the possibility to own a massive mansion and my own private jet. Maybe that sounds greedy and selfish, and to some extent it is. I will probably never own a private jet, but I like knowing there's a way to reach that goal if I work hard enough or invent something people find useful.

Humans are intrinsically greedy and crave ownership and control over things in the real world, and I think that would apply to any conscious being living in a material world. That is never going to change, and capitalism is the best system we have for focusing that energy into productive economic activity. Capitalism doesn't fight against human nature, it respects our individual liberty and gives us more control over our own future. Obviously capitalism isn't perfect, especially not when the currency is manipulated, but I don't know of any other economic system which has lifted more people out of poverty.

Free market capitalism has produced some of the most powerful and wealthy nations on the face of this Earth, and they also tend to be the nations which provide the most freedom and liberty to their citizens. Nations such as North Korea, Russia, and China are some of the most communistic nations on Earth, and they also tend to have some of the most authoritarian governments on Earth. Capitalism doesn't force us to live a certain way, it rewards people for contributing economic value and it rewards innovation. If you create a product that increases the standard of living for people then you will probably get rich.

The United States has always attracted great innovators because they know their ideas have a better chance of flourishing in a strong free market economy, and all of that innovation has dramatically increased the standard of living for everyone in the USA and the rest of the world to some extent. In fact, we can use the Economic Freedom Index to compare countries, and we find that the standard of living decreases and the cost of living increases when people have less economic freedom. Less economic freedom means less liberty and more taxes, it means markets are more tightly controlled by over-sized governments.

Note: The Average Monthly Net Salary is calculated from the Monthly Net Salary (After Taxes) of each country and adjusted using the Price Level of each country. Dataset sources: Economic Freedom Index Human Development Index GNI Per Capita Life Expectancy World Happiness Report Wealth Inequality Legatum Prosperity Index Population with Internet Population Living in Poverty

The first chart in the top left corner shows that a higher score on the Economic Freedom Index correlates to a higher score on the Human Development Index. As economic freedom increases, we also find that life expectancy increases, happiness increases, prosperity increases, and net salaries increase. We can see a different looking trend in the bottom right chart and the one above it because they are measuring undesirable things like poverty rates and wealth inequality. When economic freedom decreases we can see that poverty rates increase and wealth inequality also seems to increase, but the trend is less apparent.

Even though the trend for wealth inequality isn't as clear as all the other charts, I still think it tells us something very important. We are often told that less taxes and less regulations will result in more inequality, but this data would suggest the opposite is true, or at the very least, there is no correlation, so it's not a strong argument against free market capitalism. Some very wealthy nations have high levels of inequality, but some of the least developed nations also have very high levels of wealth inequality and income inequality. Capitalism can reduce inequality because it reduces poverty and promotes development.

You might notice that Singapore and Switzerland consistently rank very high in most of those charts, they have a very high level of economic freedom plus a very prosperous and healthy population. They both have highly advanced economies with low tax rates and a pro-business regulatory framework. The average net salary (PPP-adjusted) in Singapore and Switzerland are the highest in the world. They also rank as two of the least corrupt countries in the world despite the common perception that corruption runs rampant in free markets. Switzerland was also ranked 2nd in the world on the Human Development Index for 2023.

Switzerland has a stable, prosperous and high-tech economy. It is frequently ranked among the world's wealthiest country per capita; for example in 2024 the CIA world factbook ranked Switzerland as having the 10th highest GDP per capita (at purchasing power parity) in the world. The economy of Switzerland is one of the world's most advanced and a highly developed free market economy. The economy of Switzerland has ranked first in the world since 2015 on the Global Innovation Index and third in the 2020 Global Competitiveness Report. According to United Nations data for 2016, Switzerland is the third richest landlocked country in the world after Liechtenstein and Luxembourg. The industrial sector began to grow in the 19th century with a laissez-faire industrial/trade policy, Switzerland's emergence as one of the most prosperous nations in Europe, sometimes termed the "Swiss miracle", was a development of the mid 19th to early 20th centuries. Switzerland and the Economy of Switzerland

Unsurprisingly, the economy of Singapore is very similar:

Singapore's economy has been consistently ranked as the most open, competitive and pro-business in the world. It is also the 3rd least corrupt in the world. Singapore has low tax-rates and the highest per-capita GDP in the world in terms of purchasing power parity (PPP). The Singaporean economy is regarded as free, innovative, dynamic and business-friendly. For several years, Singapore has been one of the few countries with a AAA credit rating from the big three, and the only Asian country to achieve this rating. Singapore attracts a large amount of foreign investment as a result of its location, skilled workforce, low tax rates, advanced infrastructure and zero-tolerance against corruption. Singapore's economy is often referred to as a "miracle" due to its rapid transformation from a developing country to a developed, high-income economy in a relatively short period of time. This transformation took place in the second half of the 20th century. Singapore and the Economy of Singapore

Hong Kong was ranked the world's most free economy by the Index of Economic Freedom for 25 consecutive years. It was removed from the index in 2021 as a result of the Chinese government implementing the Hong Kong national security law. Hong Kong is a very interesting case to study, you will often see it listed as a separate country to China because Hong Kong has their own currency, legal system, parliament, etc. However, Hong Kong is not an independent country, it's technically a "Special Administrative Region" of China, and that's also interesting because China doesn't rank very high in any of these datasets.

Hong Kong on the other hand has an extremely high standard of living and it has one of the strongest economies in the world. There is also something called the Economic Freedom of the World Index which is very similar to the Economic Freedom Index but the dataset still contains Hong Kong. I used that index to create another set of charts just like those above, and the result is pretty much the same, but we can see Hong Kong is in the same league as Singapore and Switzerland. The population of Hong Kong have an extremely high quality of life and they are as wealthy as some of the richest countries in the world.

Hong Kong was ranked 8th on the Human Development Index in 2023. On the other hand, China was ranked 78th on the Human Development Index. Hong Kong ranked 1st on the Economic Freedom of the World Index in 2019, on the other hand, China ranks 100th. The average net salary in Hong Kong is similar to the United States whereas the average net salary in the rest of China is similar to what people in India get paid. Hong Kong, unlike China, take pride in having a fair and free market with very low tax rates and minimal government intervention. That approach has allowed their economy to flourish far beyond any other place in China.

The economy of Hong Kong is a highly developed free-market economy. It is characterised by low taxation, almost free port trade and a well-established international financial market. Its currency, called the Hong Kong dollar, is legally issued by three major international commercial banks, and is pegged to the US dollar. Interest rates are determined by the individual banks in Hong Kong to ensure that they are market driven. There is no officially recognised central banking system, although the Hong Kong Monetary Authority functions as a financial regulatory authority. Its economy is governed under positive non-interventionism, and is highly dependent on international trade and finance. For this reason it is regarded as among the most favorable places to start a company. In fact, a recent study shows that Hong Kong has come from 998 registered start-ups in 2014 to over 2800 in 2018, with eCommerce (22%), Fintech (12%), Software (12%) and Advertising (11%) companies comprising the majority. The Economic Freedom of the World Index lists Hong Kong as the freest economy, with a score of 8.58 based on data from 2022. Hong Kong's economic strengths include a sound banking system, virtually no public debt, a strong legal system, ample foreign exchange reserves with assets of US$481.6 billion represent over six times the currency in circulation or about 46 per cent of Hong Kong dollar M3 as at the end of March 2022. Hong Kong is classified as an alpha+ global city, indicating its influence throughout the world. It is one of the most significant global financial centres, holding the highest Financial Development Index score and consistently ranking as the most competitive and freest economic area in the world. Home to the second-highest number of billionaires of any city in the world, Hong Kong has the second largest number of ultra high-net-worth individuals. The city has one of the highest per capita incomes in the world, although severe income inequality still exists among the population. Hong Kong is the city with the most skyscrapers in the world, and the city with the highest life expectancy in the world. Hong Kong is a highly developed territory and has a Human Development Index (HDI) of 0.955, ranking eighth in the world, and is currently the only place in Asia to be in the top ten. Hong Kong and the Economy of Hong Kong

While it is true that Hong Kong has a relatively high level of income inequality, the United States has roughly the same level of income inequality. More importantly, if we look at wealth instead of income, we find that Hong Kong has about the same level of wealth inequality as Canada and we also see that the United States has much worse wealth inequality than Hong Kong. When a country has a lot of very wealthy individuals it will increase the level of inequality, but it's important to realize the least wealthy people in Hong Kong are still much more wealthy than the poorest people in most other countries.

If an individual suddenly becomes a billionaire it will increase inequality on paper, but nothing actually got worse and no one got poorer, in fact wealth increased overall. We shouldn't automatically assume that more inequality is always a bad thing because it doesn't really tell us how well off the lower and middle classes actually are. Rampant inequality can obviously become a problem so we should try to minimize it within reason. The data shows us that wealth inequality appears to drop as economic freedom increases, so the argument that more free market policies will produce more inequality doesn't hold water.

It seems in our modern times, people have been led to believe more socialism and more collectivism is the solution to all our problems. That type of thinking promises utopia while delivering hell. It doesn't matter how many times history teaches us this lesson, we always seem to repeat the same mistakes. It's perfectly understandable why people are looking for alternative solutions, the increasing cost of living is placing increasing pressure on people and they feel like the system has failed them. It's very easy to place the blame on capitalism and seek out alternatives that focus on the common good instead of greed.

However, I would urge people to really understand the core reasons why our currency is consistently being devalued over time. When a government spends money they don't really have, it's essentially a hidden tax because it produces inflation. If they didn't have the ability to expand the money supply then the value of our currency would increase in most situations, like if we have GDP growth. In that situation, I'm willing to allow the government to create some new money, as a reward for creating economic growth, and to keep the currency stable, because an ideal currency is perfectly stable and therefore perfectly predictable.

I'm not totally against the idea of fiat currency or the ability for a government to create new money, because they could create just enough new currency to cancel out deflation and keep the currency stable. My problem is when they create so much money it doesn't just cancel out any deflationary effects caused by economic growth, it actually causes inflation and devalues our currency. Two or three percent may sound small, but when it is compounding every year, a currency can quickly lose value. At an inflation rate of 2.5% it only takes about 30 years before prices will double, meaning the currency lost half its value.

The idea of debt-based money also concerns me because it essentially means our currency is backed by debt, and that seems like the opposite of what money should represent. When new debt-based money is created it also creates a debt which needs to be repaid with interest, but there is no real reason the government needs to do any of that, they could just cut out the central bank and directly create new money without lending or borrowing. The Treasury could put the money directly into circulation free of interest, and that's exactly what the United States did back when the United States Note was in circulation.

United States Notes are different to the currently used Federal Reserve Notes because they were issued by the government itself and were not backed by debt. I believe that type of fiat currency is the best choice for a government aiming to create a free and fair economy. We don't need to have a currency backed by precious metals, a fiat government currency can work, but it requires some oversight to ensure the government only expands or contracts the money supply when they need to counteract inflation or deflation. As we know, deflation can also be a very bad thing, but a gold backed currency can't do much to prevent it.

Cryptocurrency has the same issue as gold but it has been successful because it doesn't require trust in any central authority. We only need to trust the algorithm and there are hard-coded limits in those algorithms, for example there's a finite amount of Bitcoins that will ever exist. Governments don't like limits or ceilings to get in their way, and that's the true underlying reason why it's almost impossible for them to create a stable currency. There are many reasons I think the world would be a much better and fairer place if we had a stable currency, prices would be much more stable and our savings would hold value.

At the end of the day I want to see humanity thrive and I want to minimize suffering as much as possible. As a Libertarian I believe in increasing liberty and therefore prosperity for as many people as possible, but I'm also a Capitalist who believes a thriving economy is a more realistic way of increasing average living standards compared to socialist policies which are fundamentally about redistributing wealth. It's easy to believe we can solve poverty just by creating more money or increasing taxes and redistributing that wealth, but it doesn't solve any of the root problems, and often only makes the problem worse.

Just look at how the government response to COVID led to sharp price rises and a big rise in wealth inequality. That's exactly why it's so important for a currency to be based on a solid foundation, if we build our entire economic system on a poor foundation then it's not going to function properly and it may eventually fail. Free market capitalism cannot function properly when the currency used to conduct trade can be easily manipulated. Once we have a solid foundation, then we can build a fair and free economy on top of it, and the goal should be a high level of economic freedom without sacrificing social welfare.

The goal isn't to create the smallest possible government, we should seek the best balance between small and large, trimming off unnecessary fat while keeping or even expanding the parts of government which are useful. An effective and efficient government can immensely increase the standard of living for everyone, but a government which is too big or too small will not provide that same benefit. We need to finally realize that endless money creation and endless expansion of government wont solve inequality and it wont make people wealthier. What will is economic productivity and healthy business competition.

In an ideal free market economy, prices remain at a fair market rate because many different businesses are competing to sell the same product or service, and if their prices are too high people will simply shop at a competitor where the prices are lower. Obviously we don't live in an ideal world, and there are ways for capitalism to be exploited, especially by those who control a lot of wealth or power. One of the most critical flaws in capitalism is the natural formation of monopolies over time, because without any competition those monopolies can dictate prices without any regard for supply and demand.

However I would point out that heavy socialism or full blown communism is an even more insidious form of centralized monopolistic systems which control every aspect of our life. Capitalism may have flaws, but I believe those flaws are preferable to the ones found in heavily socialist systems. Moreover, there are simple ways to prevent monopolistic corporations from setting unfair prices. Some regulations are always going to be important to help reduce the issues with capitalism, but if they are well balanced and well thought out I don't think they need to infringe upon our economic freedom in a big way.

Laws which place a limit on profit margins for large corporations is probably a good thing. Products should be fairly priced based on how much they cost to produce, and regulations could help prevent monopolies from exploiting the system. Personally, I think anything more than a 50% profit margin is unfair to consumers so I'd probably cap it at that. It's worth mentioning that those big supermarket chains in Australia which have been accused of price gouging in recent years have a profit margin of around 26%. If you include wages and all other operating expenses then their net profit margin is less than 3%.

In 2025 the Australian government made new regulations to ban supermarket price gouging. According to a press release from the Treasury, the "ban will prohibit very large retailers from charging prices that are excessive when compared to the cost of the supply plus a reasonable margin". Considering how tight the operating margin is for these big chains, it seems highly unlikely they will ever need to worry about these new regulations having any impact on them. People like to have a villain they can point the finger at and blame for higher grocery prices, and that person is usually the CEO or business owner.

The cost of living has been rising all over the world, it isn't just a problem in Australia, and there are clear economic reasons for why that is happening. Laws which prevent price gouging are generally a good thing if they aim to create a fair market and don't impede on our freedom. Likewise, we shouldn't create endless reams of regulations which increase operational costs because that will push up prices and make it harder for the upstarts to compete with the monopolies. When the economy is healthy we all do better, when it's overburdened by excessive taxes and excessive regulations everyone suffers.

If a business is already operating on tight margins, and they are forced to deal with excessive regulations or large tax increases, then they will be forced to cut expenditure by letting go of people or by lowering the quality of their product. In the worst case they might be forced to move out of the country or shut down entirely. The money for government subsidized healthcare and public infrastructure comes from tax paying individuals and corporations, if those businesses move over seas or fire employees then it's not good for the economy and it's not good for the government because tax revenue decreases as a result.

Capitalism is a paradox, on one hand it drives competition and innovation, on the other hand it causes selfish behavior which can lead to inequality. I'm a realist, so when I look at the nations of the world I ask myself which have the highest standard of living and how did they achieve it. What matters isn't necessarily the gap in wealth between the rich and the poor, what really matters is the average wealth and average income of everyone. What is considered poor in a rich country may be considered wealthy in a poor country. There will always be a wealth gap, but the quality of life can still be high for those at the bottom.

If the lower class has a very high quality of life then it shouldn't matter if there are other people who are much wealthier. The people alive a few hundred years ago would look at society now and think most of us live like kings. Feeling envy because others own something you don't have isn't productive. Focus on how you can work towards getting the things you want in life by contributing some value to society, don't rely on the state to give you everything. The government will never spend money more effectively than the private sector because they don't have a strict budget and they don't face the same consequences if they fail.

The private sector is simply most effective at meeting market demand, it will always produce cheaper and higher quality products than a bloated nanny state. Not to mention there is a very high risk of corruption when the government controls production, and we know it doesn't provide the quality of life that is achieved by free market economies where people work to produce what others want in return for some compensation proportional to the work they put in. The most prosperous and innovative nations on Earth were built based on those principles and by respecting the laws of economics instead of acting like they don't exist.

Not all problems in society can be solved by throwing endless amounts of money at it. That won't solve inequality, it will only debase our currency and make us all poorer in the long run. It's not surprising that people seek out economic philosophies which appeal to their humanity, but we shouldn't allow the facts to be overshadowed by our emotions. The most righteous and ethical policies are those which show results, not those which make us feel good. Anyone can point out the flaws in capitalism but few people understand the intrinsic necessity of capitalism and how much worse the alternatives can be.